The first wave of banking and fintech apps got high marks for turning in features that allowed time-crunched customers to address important tasks. But the next wave of private finance apps is going one large step higher by not going it on my own. Driven by the realization that there’s actual electricity in numbers, smart fintech organizations are pairing, partnering, and becoming a member of forces to supply apps that provide existence solutions (no longer factor solutions) aligned with customers’ lifestyles, existence ranges, and context at the magical “mobile second” when they attain to their fiercely private gadgets for severely helpful assistance.

Last week’s tie-up among Acorns – the fastest-developing micro-investing app inside the Finance U.S. With Mobile Apps over 2 million investment bills – and Clarity Money, the hastily growing private finance app with 450,000 users founded through Adam Dell, brother of Dell Technologies CEO Michael Dell, is trendy in a raft of bulletins by using fintech startups decided to redefine personal finance.

Revolut, the app-primarily based virtual simplest bank, announced a partnership with pension supervisor PensionBee, permitting Millennials to mix their pensions in a single plan, including extra allowances as they switch jobs. Starling Bank in the U.K. Became the first inside you. S. Transferwise, giving Starling customers direct, in-app admission to TransferWise’s cash transfer services. Stock trading app Robinhood, which already teamed up with StockTwits’ actual-time social network for the economic and investing network, brought TradeIt to its roster of companions, ensuring users can view brokerage money owed, place trades, and fund their account without exiting the enjoy, regardless of which broking they use.

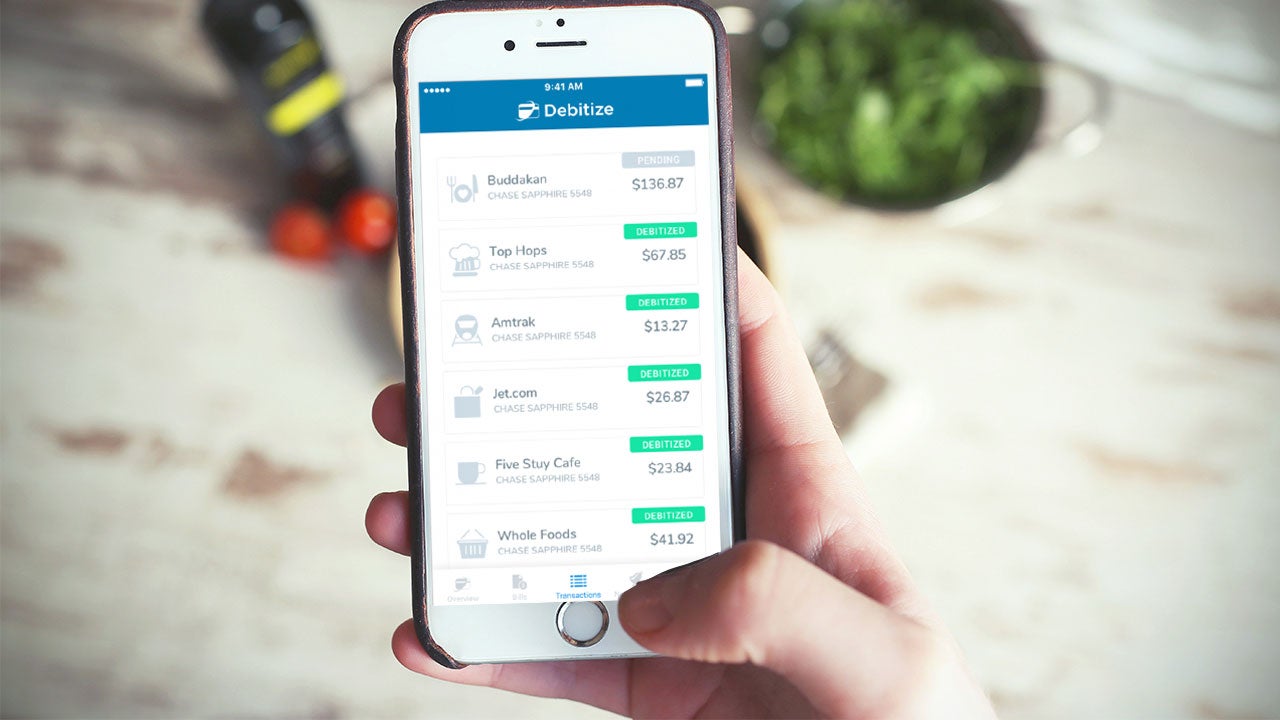

It’s a flurry of interest to fill the growing “revel in the gap” in what financial services offer and what customers have come to call for, observes Sameer Singh, industry evaluation director at app marketplace facts issuer App Annie. “Finance apps started out intending to remedy particular issues.” But slim attention and rigid UI are out as greater fintech startups band collectively to interrupt new floors with apps that lower customers back on top of things.

Little wonder that App Annie calls out finance apps as one of the top app categories poised for massive growth (the alternative is cell commerce). From the information presented solely to Forbes, Singh notes that the remaining years have a visible “extraordinary boom” in-app sessions in the U.S. On my app, sessions on Android are up 50% to reach almost 22 billion, up from 14 billion in 2014. In Europe (consisting of Russia and Turkey), app sessions on the Android platform extended a whopping 180% to attain over 55 billion classes in 2016, up from simply under 20 billion courses in 2014.

App Annie counts around “200 billion monetary apps periods globally across iOS and Android.” The marketplace is growing – but so is the competition as greater fintech agencies (or even traditional banks) jockey for position to become what Singh calls “the only-stop gateway for a variety of financial wishes through a fair wider atmosphere enabled by apps.”

Automated an investment and smart financial savings

This is the ambitious plan in the mind of Noah Kerner, Acorns CEO. “An essential problem for customers is that fintech is making the monetary offerings increasingly fractured,” he explains in an e-mail response to my questions. “This approach means that a person may have five or moreps to manage their cash. Since all of us have restricted time and staying power, there will, in the long run, be a ‘re-bundling of services to meet the wishes of the time-crunched patron.”

With the advent of messaging apps, how people use social media has drastically shifted. These days, users worldwide log onto messaging apps to chat with friends, search for products, connect with brands, and watch content. Gone are the days when they were just simple add-ons to your smart device for exchanging pictures, messages, GIFs, and videos.

Scope of Messaging Apps

Though their invention occurred because of some different intended purposes, instant messaging applications serve various purposes. Being a basic element of almost every smartphone, they transform digital communication between brands and consumers. Following are some potential aspects that show how they are overtaking social media apps in terms of utility.

A Dynamic Marketing tool

The shift from social media networking to messaging is one of the biggest changes in Internet culture. Consumers consider these as more enclosed compared to social media. Thus, with the help of instant messaging apps, marketers can directly reach customers’ chat boxes. Several global brands focus on experimenting with these opportunities to boost the level of Individual Conversions.

A Virtual Space for Video Calling

Enterprises are using messaging apps as an integrated collaboration tool. They offer a range of functionalities, including ease in setting up, audit trail, and security level, which surely overtake social media apps’ potential. Online video communication backed up by HD audio, screen sharing, or video clarity is very helpful for enterprises. They help enterprises to gather several people in a single video call. While having access via mobile, they can connect anywhere and work as a team, preventing physical presence from acting as an obstacle.

A Customer Service Portal

Customer service is getting more personalized with these apps. Many businesses are building AI-based chatbots to respond to customer queries easily. Furthermore, many customer service providers can use them to upsell, arrange meetings, and even answer customer queries via IM chat.

A Global Learning Centre

The route to higher learning for students has become easier with instant messaging apps. Many universities use them to help students prepare assignments and connect with teachers. Furthermore, custom-built apps allow students to improve relationships with teachers and accelerate learning. The possibilities for growth with messaging apps are endless. With their expanding scope of usage, we will open a whole new dimension of opportunities for businesses of all sizes and marketers shortly.